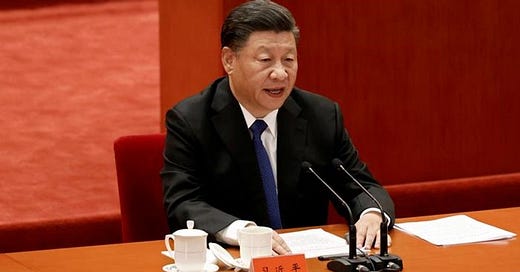

Xi Faces Unaccustomed Headwinds in 3rd Term Bid

Protests over banks, mortgage strike and potential domestic opponents challenge China’s leader

Chinese President Xi Jinping’s plans to give himself an unprecedented third term at the 20th Congress of the Chinese Communist Party (CCP) later this year face more turbulent headwinds than expected, although few think he will be thwarted.

Nonetheless, Xi is facing a massive mortgage boycott from bilked Chinese homebuyers, protests over bank deposit freeze in Henan province, rising protests against the Covid-19 crackdown which has driven down gross domestic product growth to 4.5 percent and caused Beijing to miss its growth target for the first time in three decades, and potential domestic opposition.

“Xi Jinping will not only secure a precedent-breaking third term at the eagerly anticipated Party Congress this autumn, he will also be crowned ‘people’s leader’ by the party, reported the pro-Beijing Hong Kong newspaper Ming Pao,” tweeted Diana Choyleva, chief economist of Enodo Economics, a macroeconomic and political forecasting company in London, on July 21. “Not since Chairman Mao, and successor Hua Guofeng, has a party figurehead been given the official title of ‘leader.’ Whatever title he emerges with, expect China to remain Xi’s China after the Party Congress,” Choyleva tweeted.

It is clear from recent announcements of anti-corruption probes of many Chinese state organizations, however, that Xi is seeking to tamp down domestic opposition with an anti-graft campaign. On July 23, the website of China’s two anti-corruption agencies, the Central Commission for Discipline Inspection (CCDI) and the National Supervisory Commission (NSC), announced the findings of inspections of 25 government bodies and state-owned companies. Ironically, the targets of the probes include the CCDI and NSC themselves.

Other targets include the Hong Kong and Macau Affairs Office and the Organization Department of the Chinese Communist Party, an important organ which exercises enormous control over the staffing of party personnel. The announcement of evidence of potential corruption has been referred to the relevant authorities. This indicates a high probability that some leaders will be arrested and charged.

One motive for such anti-graft probes of so many state organizations is to weed out people deemed disloyal to Xi, a China watcher told Asia Sentinel. Another purpose is to keep the party on its toes, especially with a major top-level personnel reshuffle at the 20th Party Congress, said the China watcher, who declined to be named. As Asia Sentinel also reported on July 11, recent criminal trials of two major figures, one of former Public Security Vice Minister Sun Lijun and the other of former billionaire Xiao Jianhua, were regarded as clearing the way for Xi’s projected third term.

Mortgage strike

Earlier in July, many homebuyers in mainland China announced on social media their refusal to pay the mortgages on long-stalled apartments which were not yet completed and were due to be handed to them after completion. As the ongoing debt woes of Chinese property developers worsened, some developers were unable to complete and deliver properties to buyers.

“The development more likely reflects prolonged and widespread distress in the property-development sector, which drove the suspension of construction at a number of pre-sold housing projects,” said a report by Fitch Ratings on July 18.

A rise in the number of Chinese homebuyers ceasing mortgage payments on properties where construction has been suspended for a prolonged period could weaken banks’ asset quality, said Fitch, adding that failure of policy intervention to restore homebuyer confidence could test the banking system’s resilience and heighten liquidity pressure on developers.

“Investors’ biggest fear has been that a mass default on mortgages will lead to a banking system collapse,” said a July 20 report by Morningstar, a US financial services firm, “More than 100 real estate projects across 19 provinces and municipalities are reportedly exposed to mortgage defaults,”

China Evergrande Group has been in a slow-motion slide toward disaster for months, with 34 projects facing defaults, said Morningstar. Evergrande was once the biggest Chinese developer by revenue and is now the world’s most indebted property firm with an estimated US$300 billion in debt. The Hong Kong-listed firm defaulted last December.

On July 22, Evergrande announced it had dismissed its chief executive officer Xia Haijun and chief financial officer Pan Darong as well as Ke Peng, executive president of its subsidiary Hengda Real Estate Group, for their role in amassing the company’s borrowings of RMB2.7 billion (US$400 million), on which Evergrande defaulted last September. Shawn Siu and Qian Cheng have become the new chief executive officer and chief financial officer, the company announced.

“A mortgage rebellion by middle-class Chinese homeowners could force Xi Jinping to backtrack on his housing policy – a key pillar in his “common prosperity” vision – and more generally pledge significant changes to his quasi-Maoist policies of emphasizing Party-state control over the economy,” said Enodo Economics.

“Homebuyers’ recent choice to withhold mortgage payments, thus drawing banks into their dispute with property developers, could prove more effective in reining in China’s lurch towards a command economy under Xi than anything his political rivals have been able to accomplish,” Enodo Economics added.

“While the size of the mortgage rebellion is manageable for now, if it broadens to encompass well-off urbanites’ overall frustration with Xi’s attempt to lower house prices and redistribute income, the CCP will have a much more serious social problem on its hands,” Enodo Economics warned.

At a press conference on July 21, Liu Zhongrui, an official of the China Banking and Insurance Regulatory Commission (CBIRC), said the CBIRC is working with other Chinese government bodies to ensure the delivery of completed property units, protect the people’s livelihood and maintain stability in the property market. The CBIRC will guide banks to resolve funding shortages in order to enable property projects to be completed, Liu said.

The defaults will not directly affect Fitch-rated Chinese banks, with most disclosing that affected mortgage loans amount to less than 0.01 percent of their outstanding residential mortgage loans, said Fitch. “However, should defaults escalate, there could be broad and serious economic and social implications.”

Even in a bearish scenario where the Chinese government fails to step in and ensure home delivery to buyers, at worst Chinese banks will endure a 2.4 percent hit on their profits, said the Morningstar report.

“We believe the mortgage issues will be small in scale and not post significant threats to the financial system, as the root cause of this problem is not a sharp deterioration in households’ balance sheets, but fear over developers’ liquidity,” said Morningstar senior equity analyst Iris Tan.

“Investor sentiment for banks is extremely low, driven by separate events, including the Henan village bank incidents, trust product disputes, and mortgage issues, but we believe the media has overhyped risks in China’s financial system and the possibility of a financial crisis,” Tan said.

Protests over banks

In the past few months, bank depositors held demonstrations in Zhengzhou, the capital of the Chinese province of Henan over four rural banks in Henan which have frozen deposits, while a rural bank in another Chinese province, Anhui, also froze them. On July 10, hundreds of people protested against alleged corruption by local officials in Zhengzhou, according to media reports.

“The pushback by bank depositors demanding their life savings back and condemning government corruption is another manifestation of the huge challenges Beijing faces at present,” Choyleva tweeted on July 20.

On July 24, the CBIRC announced on its website that an investigator at CBIRC’s branch in Henan province, Li Huanting, is being investigated for corruption.

At the press conference on July 21, CBIRC spokesman Qi Xiang said the five rural banks in Anhui and Henan provinces have started reimbursing their depositors. A second round of reimbursement began on July 21 for people who have each deposited RMB100,000 or less in these banks, Qi said.

With problems like the Henan protests and mortgage boycott, it means Xi has to “listen” more, said the China watcher. These issues may result in princelings (relatives of current and former senior Chinese officials) having their people, whose views do not entirely align with Xi’s, installed in senior positions at the 20th Party Congress, the China watcher predicted.

“Although Xi is very powerful now, he is losing support among the middle class and big city elites in China,” said Andre Wheeler, chief executive officer of Asia Pacific Connex, an Australian consulting firm. “There are 400 million people in China's middle class affected by the property crisis.”